Borang Tp3 Guide

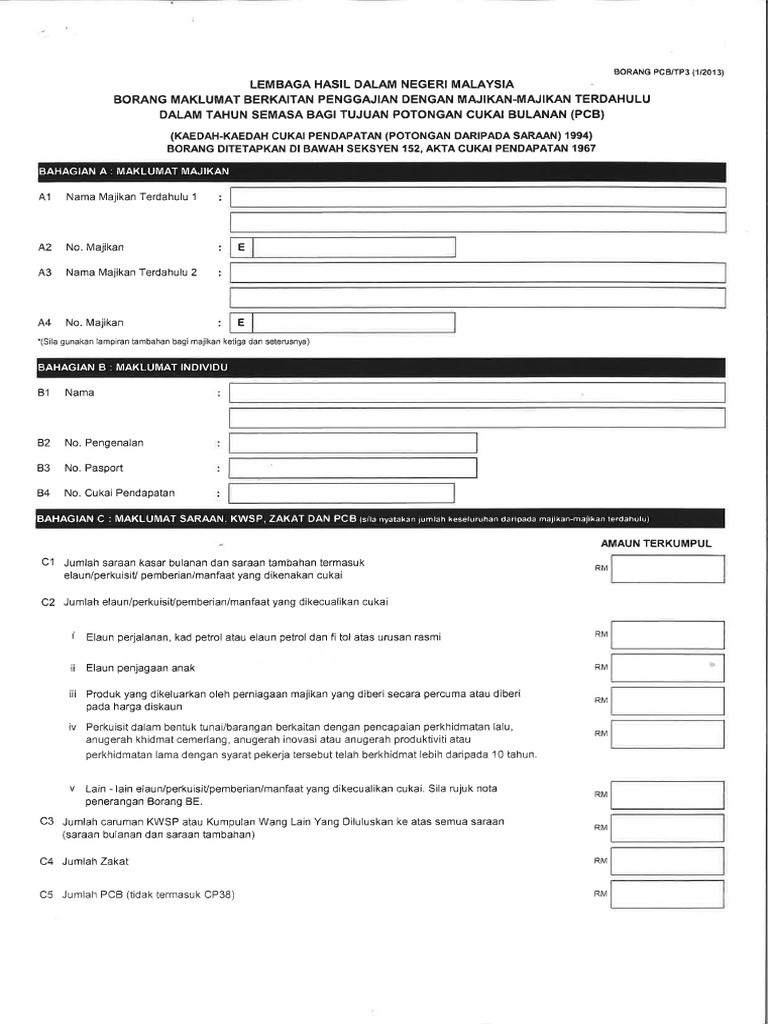

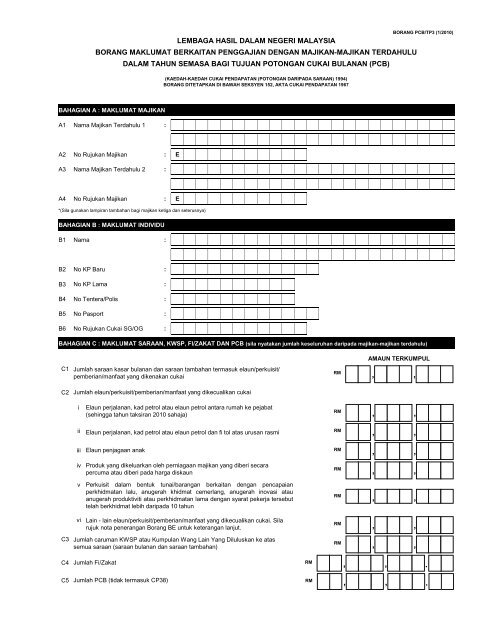

Borang maklumat berkaitan penggajian dengan majikan majikan terdahulu dalam tahun semasa bagi tujuan pcb.

Borang tp3 guide. E sila gunakan lampiran tambahan bagi majikan ketiga dan seterusnya. Amendment on tp3 form bahagian d to reschedule the item and inputting the new deduction as propose below. Exhibit 1 borang pcb tp3 1 2015 bahagian a. Enter your salary or staff.

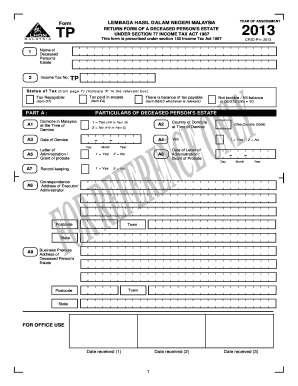

Guide to filing in form in lieu of cp39. Since when my new company hr need to know about this thank you. I will be joining new company on july 2019. Purpose malaysia personal income tax is based on current year annual income.

New company require me to fill up borang tp3. Hi my new company hr asked me to fill up a form of my total gross salary pcb amp. E sila gunakan lampiran tambahan bagi majikan ketiga dan seterusnya. Do i only need to declare my income pcb from jan 2019 until june 2019 for old company current company.

Employee s full name as per identity card or passport for foreigner. Tp3 as per malaysia inland revenue board irb requirement employee who newly joined the company during the year shall submit tp3 form to his her new employer to notify information relating to his employment with previous employer in the current year. Borang ini boleh dimuat turun dan dihantar kepada majikan baru. 5 amendment on tp1 form bahagian c to reschedule the item and inputting the new deduction as propose below.

Borang pcb tp3 1 2019 lembaga hasil dalam negeri malaysia borang maklumat berkaitan penggajian dengan majikan majikan terdahulu dalam tahun semasa bagi tujuan potongan cukai bulanan pcb kaedah kaedah cukai pendapatan potongan daripada saraan 1994 borang ditetapkan di bawah seksyen 152 akta cukai pendapatan 1967 acp. Monthly tax deduction mtd for computerised calculation employee s resident status. Or i would need to declare for last year 2018 as well. E a3 nama majikan terdahulu 2.

The form he asked me to fill up is called as borang pcb tp3 1 2013 i thought this form is between me and income tax depart. Ii tp3 form deletion of item d6 d7 and d9. Employee or salary number. Maklumat majikan a1 nama majikan terdahulu 1.

Borang pcb tp3 1 2010 lembaga hasil dalam negeri malaysia borang maklumat berkaitan penggajian dengan majikan majikan terdahulu dalam tahun semasa bagi tujuan potongan cukai bulanan pcb kaedah kaedah cukai pendapatan potongan daripada saraan 1994 borang ditetapkan di bawah seksyen 152 akta cukai pendapatan 1967. But i already submit be form for year 2018. State your employer s full name. Employer s income tax number e number can be obtained from your employer or form ea ec.

E a3 nama majikan terdahulu 2. Borang permohonan pertukaran alamat.