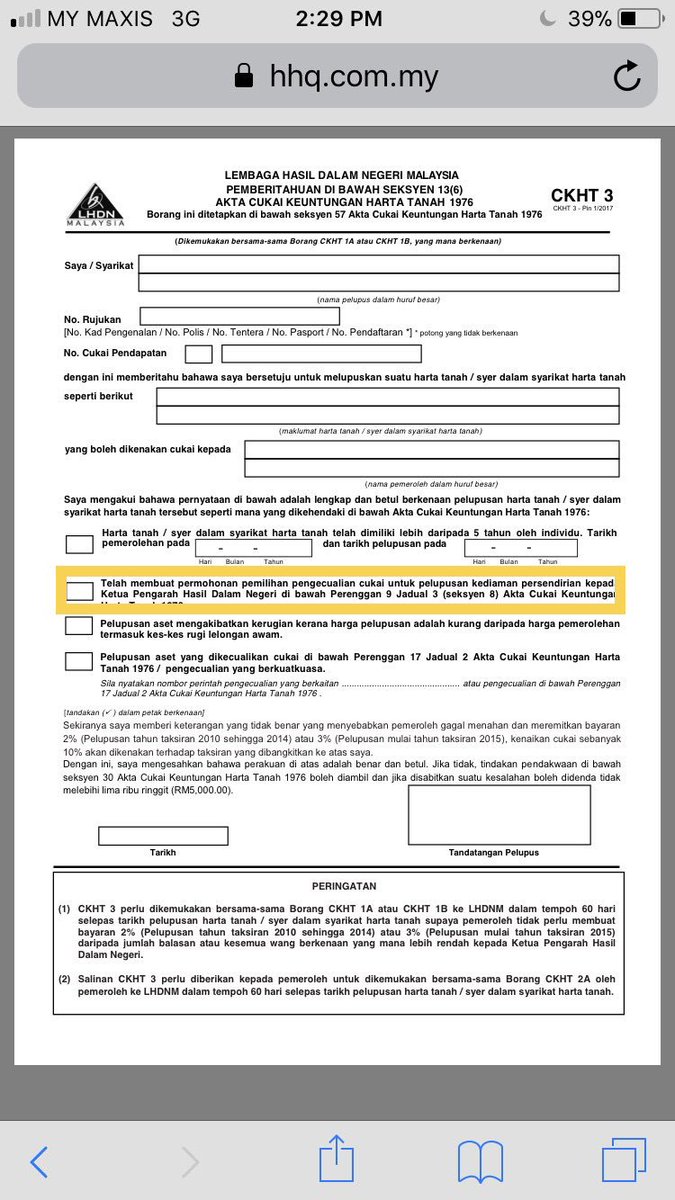

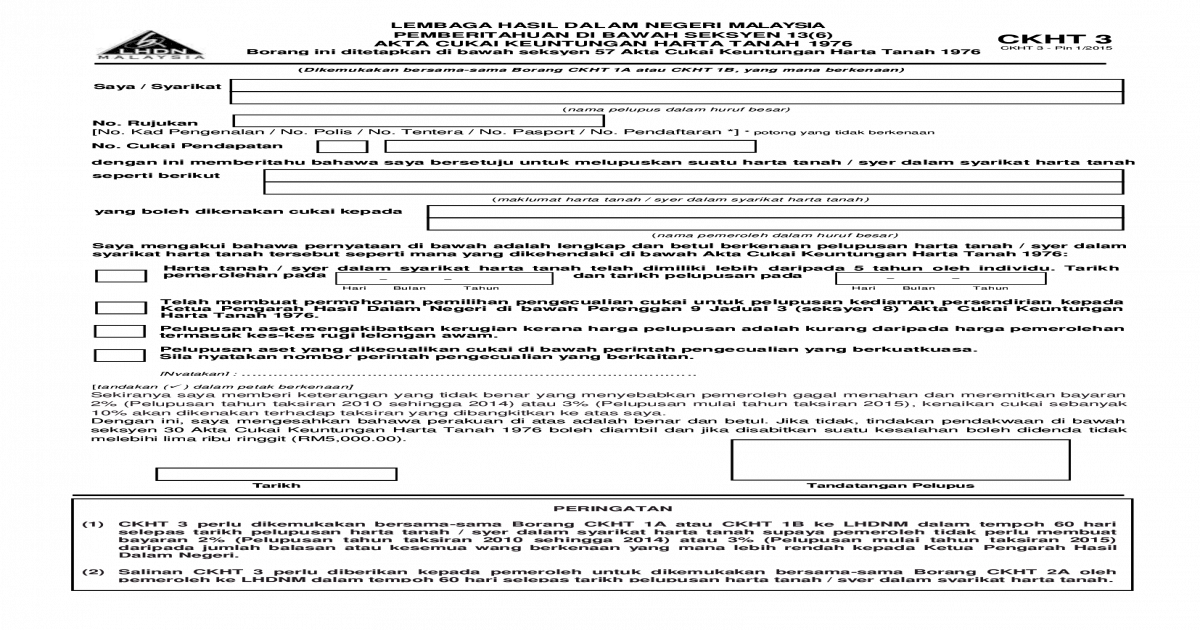

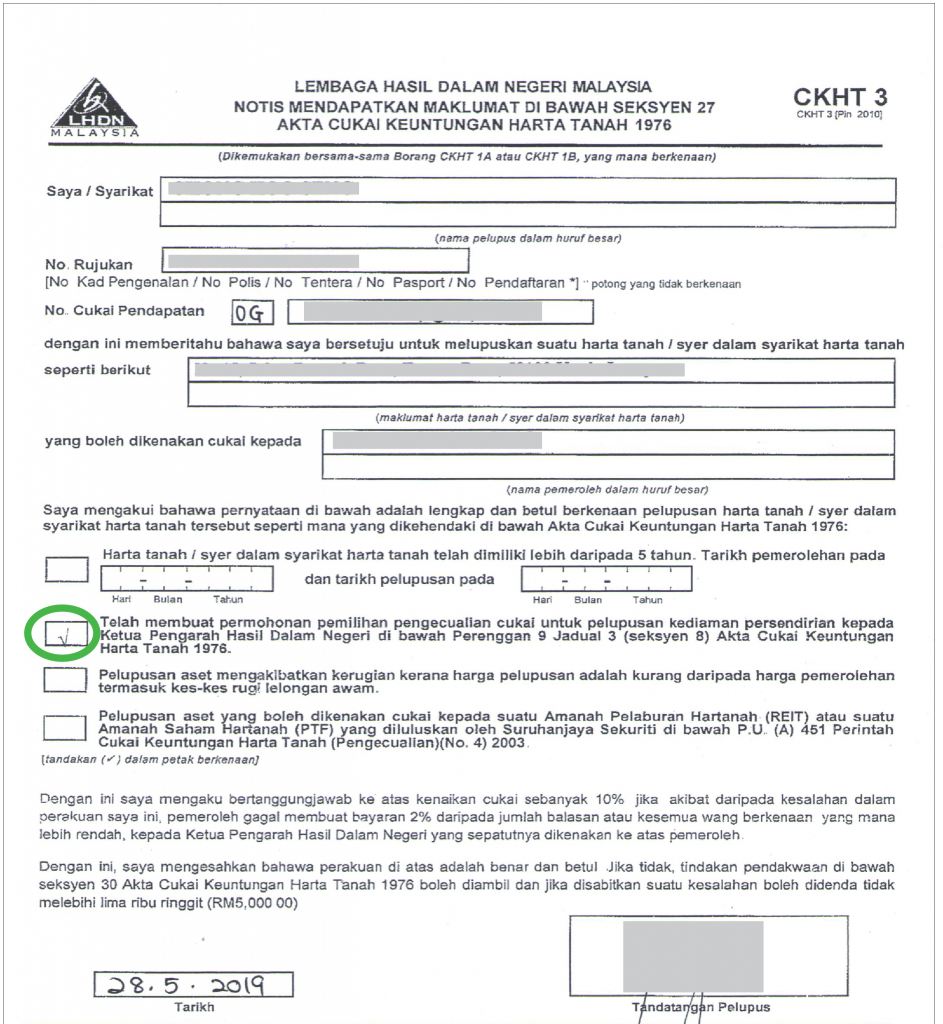

Form Ckht 3

If the seller is an individual selling the property after five years the seller or seller s lawyer will file form ckht 3 to apply to be exempted from the 3 retention sum.

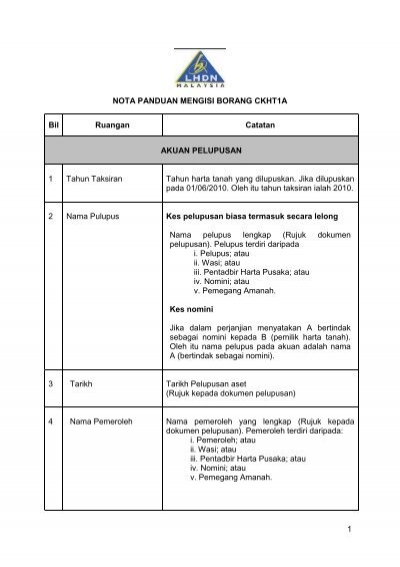

Form ckht 3. 2 irb notices the irb will issue the notice of assessment form k for the cases that attract rpgt ie there are gains arising from the disposal sale of real properties or shares in real property companies. Fill out the ckht 1a form disposal of real property. The remittance of 3 or 7 is not required. Disposal of assets which involved one acquisition date only.

13 pengisian ckht 3 adalah tertakluk kepada keadaan keadaan yang disenaraikan pada borang berkenaan. If the disposal of an asset exceeds one acquisition date the submission of the form ckht 1a must be made manually. Please attach the form ckht 3 along with the ckht 2a if you obtain a copy from the disposer. Transaction of disposal and acquisition for property only form ckht 1a ckht 2a ckht 3 individual disposers acquirers who register as e filing users.

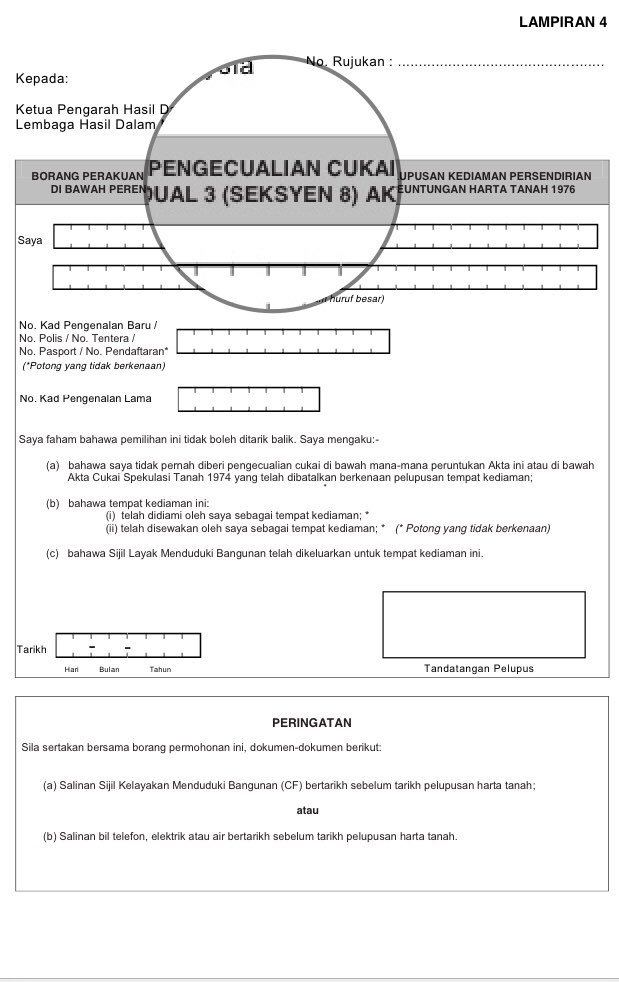

Make sure your buyer fills out the ckht 2a acquisition of real property form and include a copy of the sale and purchase agreement as well. Rpct rates w e f 01 january lhdn malaysia real property disposer return form ckht ia return form ckht 3 copy of stamped sale purchase agreement memorandum of transfer form 14a national land code for acquisition and. For exemptions fill out form ckht 3 notification under section 27 rpgta 1976 5. Ckht 3 malaysia ckht dalam negeri pemberitahuan di bawah seksyen 13 6 akta cukai keuntungan harta tanah 1976 borang ini ditetapkan di bawah seksyen 57 akta cukai keuntungan harta tanah 1976 b syarikat dengan ini memberitahu bahawa saya bersetuju untuk melupuskan suatu harta tanah syer dalam syarikat harta tanah 3 pin 1 2020 seperti berikut.

Pastikan borang ckht 1a diisi dengan lengkap dan jelas. Pastikan setiap pelupus mempunyai nombor rujukan cukai pendapatan. Based on form ckht 1a submitted by the seller the irb will then assess the requisite rpgt chargeable and refund the balance of the 3 retention sum if any to the seller. Ckht 3 borang ini hanya diisi supaya pemeroleh tidak perlu membuat bayaran di bawah seksyen 21b daripada jumlah balasan atau kesemua wang berkenaan yang mana lebih rendah bagi pelupusan tertentu seperti yang dinyatakan dalam ckht 3 syarat syarat cetakan borang.

14 isikan lampiran 3 4 atau 5 sekiranya ingin membuat pengiraan sendiri sebagai pembelajaran cukai. Lastly submit these forms and any other supporting. Submit all the forms and documents to the irb office. Wait for your confirmation notice.

Acceptance of real property gains tax form by the irb. Upon receipt of the relevant return forms ckht 1a 1b 2a 3 the irb will process them provided they are duly completed. If the disposal is not liable to rpg t the disposer may submit form ckht 3. Any form which is incomplete will be returned to the disposer or acquirer.

If you re applying for one of the rgpt exemptions then you should also fill out the ckht 3 notification under section 27 rpgta 1976 form.