Income Tax Borang Cp22a

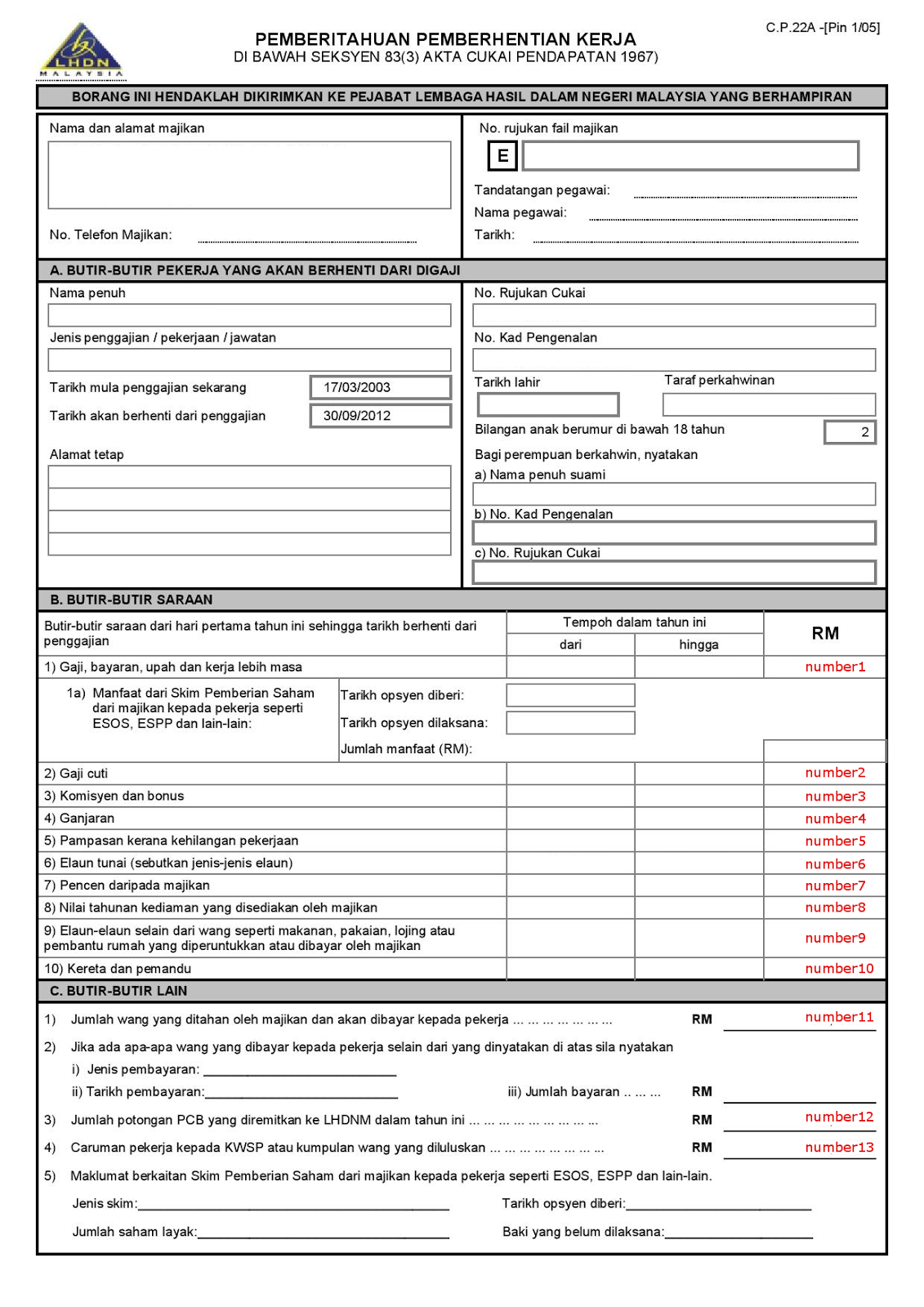

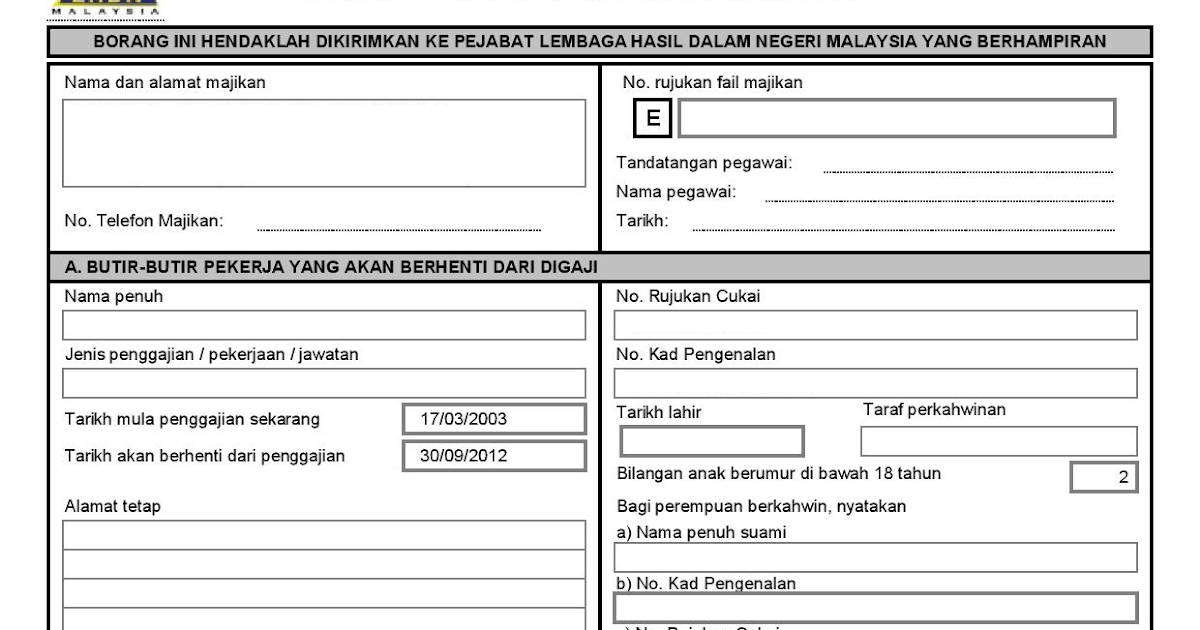

You might find out some columns are empty when you preview the borang cp22a from payroll system.

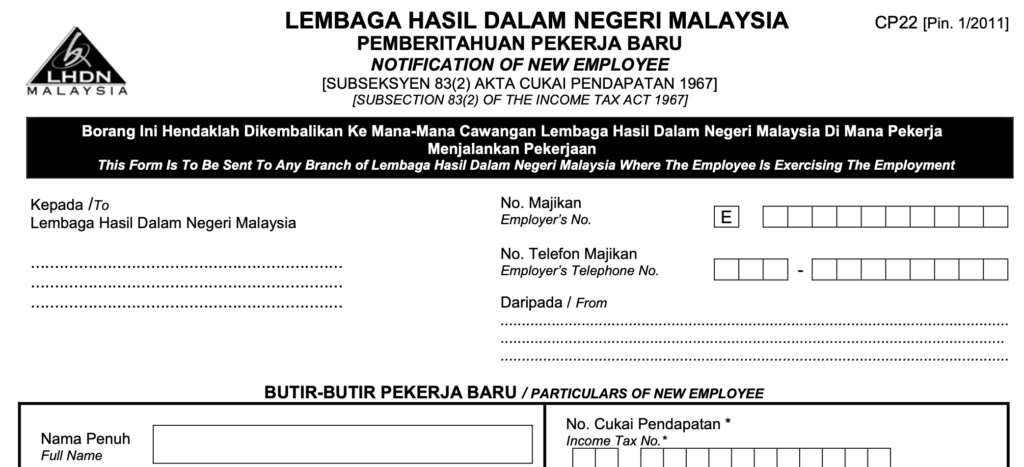

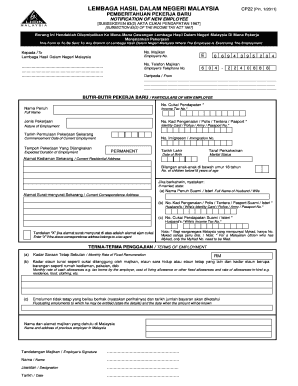

Income tax borang cp22a. Call our taxpayer advocate at 877 777 4778 or. 1 2011 pemberitahuan pekerja baru notification of new employee subseksyen 83 2 akta cukai pendapatan 1967 subsection 83 2 of the income tax act 1967. What if i haven t been able to get answers after contacting irs several times. If you want help appealing a cp22a notice request a free consultation.

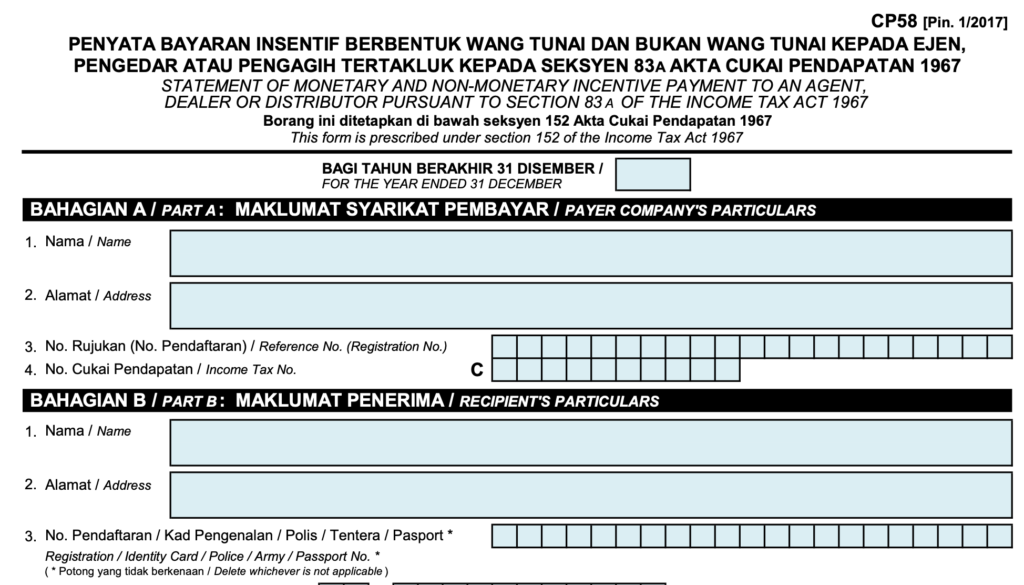

Form 1 form 2. Simply file form 1040x amended individual income tax return. Yearly remuneration statement ea ec form refer to section 83 1a income tax act 1967 with effect from year of assessment 2009 every employer shall for each year prepare and render to his employee statement of remuneration of that employee on or before the last day of february in the year immediately following the first mentioned year. For columns highlighted below please fill in based on own record.

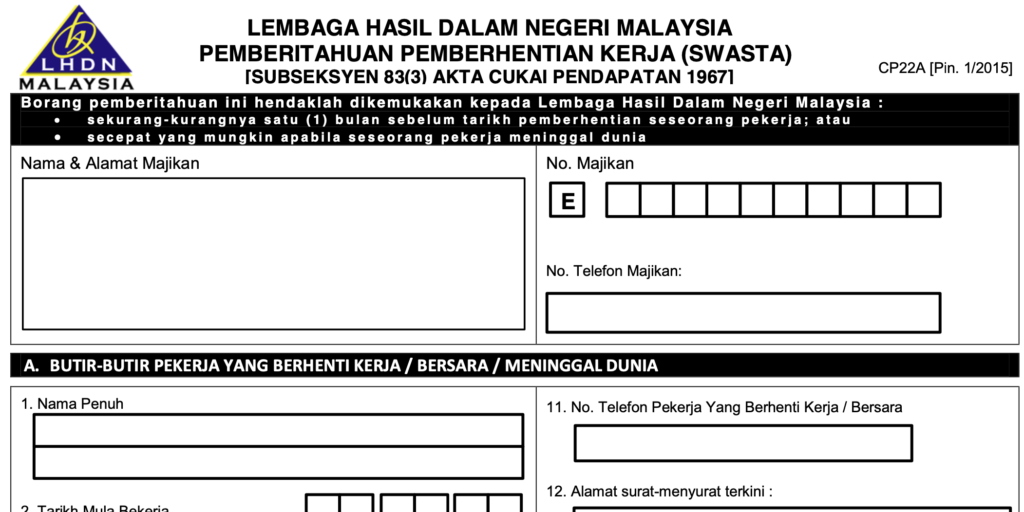

Part b butir butiran saraan. Butir butir pendapatan yang belum dilaporkan and. Atau secepat yang mungkin apabila seseorang pekerja meninggal dunia nama alamat majikan no. It is important to understand the obligations under the law as these obligations are mandatory and failure to comply with these obligations would result in penalties to be imposed.

Borang pemberitahuan ini hendaklah dikemukakan kepada lembaga hasil dalam negeri malaysia. Form cp22a pin 1 2015. Be sure to have a copy of your notice and your tax return before you call. Individual income tax return.

Application for an approved research project under section 34a of the income tax act 1967. Sekurang kurangn ya satu 1 bulan sebelum tarikh pemberhentian seseorang pekerja. As an employer are you aware of the reporting obligations under the malaysian income tax act 1967. Thus we would like to highlight the following for your immediate attention notification of new employee form cp22 the employer must notify the nearest assessment branch within one month from the date of commencement of employment of an individual who is subject to or may.

Non resident employee mtd of an employee who is not resident or not known to be resident in malaysia shall be calculated at the rate of 26 of his remuneration. This form can be downloaded and submitted to lembaga hasil dalam negeri malaysia. Borang permohonan penangguhan bayaran anggaran cukai available in malay language only jenis borang. Recently irbm is enforcing the rules on form cp22 and 22a in relation to the notification for new and resign employee.

That puts you in contact with reputable tax professionals who can help you appeal tax debt set up payment plans apply for penalty reduction and more. Guideline for personal tax clearance form cp21 cp22a cp22b.